IDComplete®

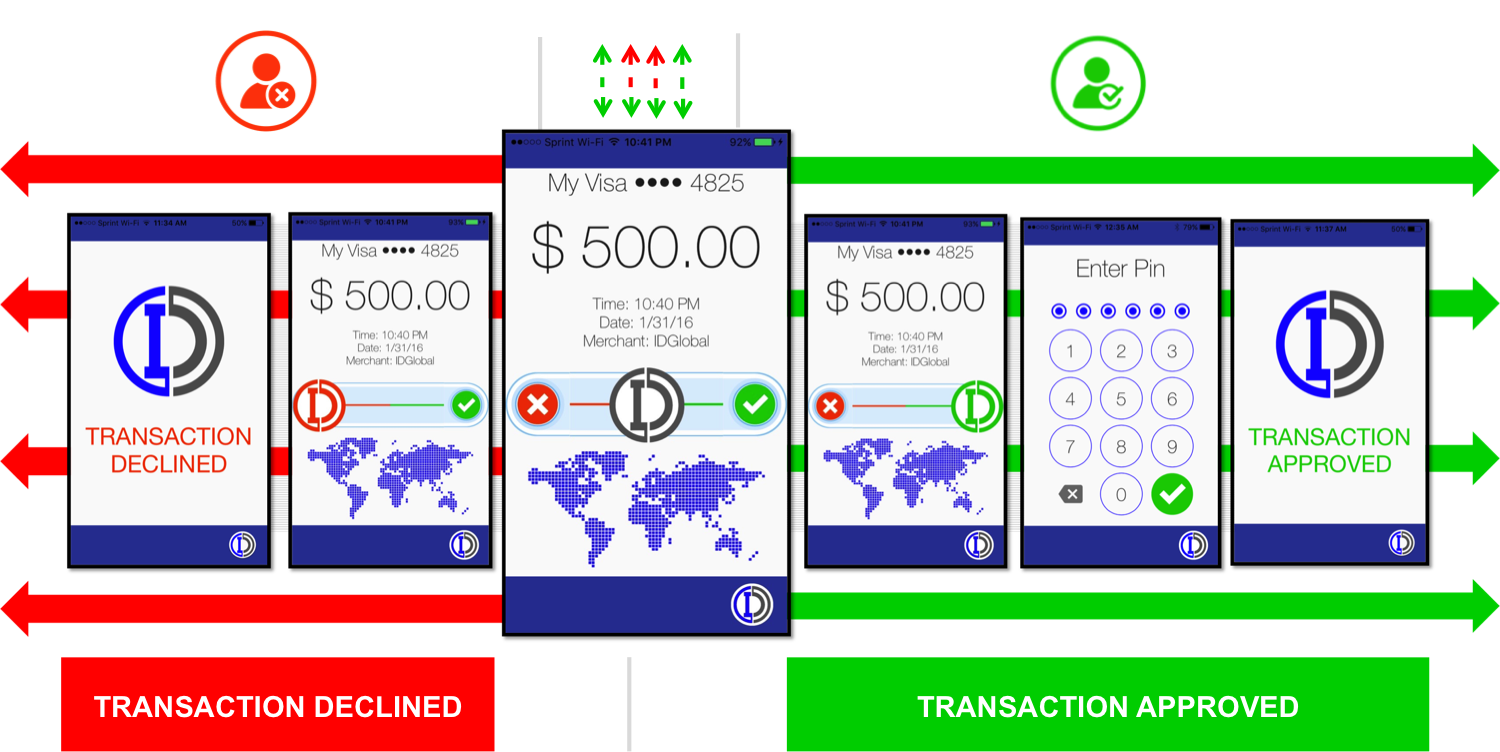

IDComplete is a highly secure, encrypted, real-time, multi-user, out of band, pin-based verification solution to prevent card fraud. IDComplete utilizes a secure encrypted irreversible tokenization process with multi-factor authentication to enable secure real-time cardholder verification. IDComplete enhances the security of physical card and digital token transactions providing consumers the ability to authorize or decline card present and card not present transactions in real time using their registered smartphones. IDComplete is deployed by the card issuer and offered to their customers to eliminate fraudulent transactions.

IDComplete strengthens an Issuer's fraud mitigation practices by enabling real-time verification capabilities for all types of transactions that has been deemed by the Issuer as a high risk for fraud transaction per their risk assessment. These high risk transaction verification triggers include Card Not Present, Card Present, Geo Location, Dollar Amount, Merchant Type, Time, etc.

IDComplete® Overview

+

Enhances issuer’s existing card fraud mitigation practices

+

Operates within the guidelines of existing Cardholder Association Rules

+

No software modifications within the Acquiring network

+

No software or hardware required at Merchant Point of Sale Terminals

+

Offers an alternate methodology for cardholder verification

+

Deployed as a SaaS, On-Premise, or Hybrid model

+

Highly configurable with regards to features and functionality

IDComplete® Benefits All in the Transaction Process

1.) Card Issuer = Eliminates direct loss bound by cardholder laws holding the Issuer responsible for fraudulent transaction costs.

2.) Consumer

= Eliminates risk of fraudulent card transactions.

3.) Merchant = Eliminates charge backs and refunds resulting from fraudulent transactions and a merchant’s direct loss of money.

4.) Acquiring Bank

=

Eliminates fraudulent transactions within their network.

5.) Payment Gateways / Platforms

= Eliminates fraudulent transactions to merchants serviced.

IDComplete®

for Open Network Transactions

Card Not Present Transactions (CNP)

+ Enables Pin Based Cardholder Verification

+ No software modifications are required within the acquiring network

+ No software modifications required for merchant websites

+ More Secure than EMV

Card Present Transactions

+ Supports all EMV Standards

+ Reduces risk of fraud in the event no EMV is implemented on a POS terminal

+ No software required within the acquiring network or on the POS terminal

+ Delivers a secure pin based solution which prevents fraud for merchants and issuers

+ More Secure than EMV

Gift Card Transactions

+ Enables Pin Based Cardholder Verification

IDComplete®

for Closed Network Transactions

Loyalty Platforms, Institutional Currencies, University IDs, and Token Dollars

+ Eliminates Interchange and all fees related to open network transactions

+ Enables Pin Based online Cardholder Verification

IDComplete® for Specialized Applications

+

Enables Pin Based Access and Identity Protection